INTRODUCTION

The United States trade relationship with sub-Saharan Africa remains underdeveloped. In fact, U.S. trade with Africa has been declining since 2011. Currently, only approximately 1.5 percent of U.S. exports are to sub-Saharan Africa. At the same time, economic growth in Africa from 2004 to 2014 averaged 5.8 percent, though in 2015 growth was only 3.75 percent, in large part reflecting the decline in commodity prices—a key export for many Africa countries—in response to the slowing growth rates in China. [1]

Robust economic growth rates in sub-Saharan Africa will be key if the continent—where over 40 percent are still living in poverty—is to achieve the Sustainable Development Goals. One important way of supporting African growth and opportunity is through increasing African engagement with the international economy through increased participation in international trade.

U.S.-Africa trade

The African Growth and Opportunity Act (AGOA) underpins U.S. trade with sub-Saharan Africa. AGOA has been extended and reauthorized on four occasions, most recently in 2015 until 2025.

AGOA provides exports from sub-Saharan Africa preferential access to the U.S. market. The U.S. also provided preferential access for sub-Saharan Africa exports under its Generalized System of Preferences (GSP), a program that applies to exports from most developing countries. The GSP expired in 2013, but under AGOA GSP preferences remain available for AGOA-eligible countries. AGOA, combined with the GSP, provides duty-free access to the U.S. for 6,400 product lines from 38 countries in sub-Saharan Africa. Of total U.S. imports from AGOA countries, around 70 percent enter under AGOA.

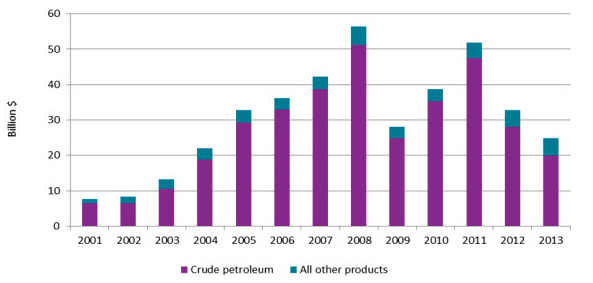

From 2001 to 2013, exports under AGOA increased from $7.6 billion to $24.8 billion but declined over 50 percent in 2014 to $11.6 billion mainly due to reduced petroleum exports to the U.S. Anecdotal and survey-based evidence has found that African businesses view AGOA as very important for their trade with the U.S.

By enabling increased trade, AGOA supports local businesses and their integration into the global economy. AGOA has also stimulated foreign investment in sub-Saharan Africa, often by companies taking advantage of the new market access opportunities back in the U.S. For instance, U.S. retailers such as Gap, Target, and Old Navy source goods in Africa for export to the U.S.[2]

AGOA is also an important tool for achieving broader U.S. goals such as promoting market reforms and building democracy. These goals are achieved through its role in strengthening growth opportunities in sub-Saharan Africa broadly. In fact, in order for a country to be eligible to receive AGOA’s trade preferences, compliance with the following conditions is necessary:

- The country must be making progress towards a market-based economy, enhanced rule of law, elimination of trade barriers and systems to combat corruption, and the protection of worker’s rights;

- The country must not be engaging in activities that undermine U.S. national security;

- The country must not be engaging in gross violations of human rights.

AGOA-eligible countries in sub-Saharan Africa are making significant economic reforms that are improving their capacity to grow and providing new opportunities to deepen their economic relationship with the U.S. The 2015 World Bank Ease of Doing Business Report found that sub-Saharan Africa accounted for the largest number globally of regulatory reforms that reduced the cost of doing business.[3] Democratic governance is also on the rise in sub-Saharan Africa. According to a Freedom House report, the largest gains in freedom over the last five years have been in sub-Saharan Africa.[4]

Notwithstanding the growth in U.S.-African trade since AGOA, there remains significant scope to increase its depth and range. For instance, Africa exports 10 times as much to Europe as it does to the U.S. The European “equivalent” trade scheme—the “Everything but Arms” initiative—has a higher utilization rate than AGOA and is estimated to have generated almost twice as many exports than AGOA.[5] The conclusion by the European Union of Economic Partnership Agreements with a number of countries in sub-Saharan Africa is also providing enhanced market access.

The composition of U.S.-Africa trade

As Figure 1 demonstrates, U.S. trade with Africa is dominated by crude petroleum exports, which account for approximately 90 percent of all U.S.-Africa trade. The impact of AGOA on crude oil exports to the U.S. has been limited as these products were entering the U.S. duty free under the GSP anyway.

FIGURE 1: U.S. IMPORTS UNDER AGOA, 2001-2013

Source: United States International Trade Commission (USITC) DataWeb/USDOC.

Since 2011, exports of crude oil to the U.S. have declined and the most data shows a continuation of this decrease due to increases in the U.S.’ production of oil. Given this trend, failure to grow sub-Saharan Africa’s non-oil exports to the U.S. could see a significant deterioration in the overall economic relationship.

The following graph disaggregates exports to the U.S. other than crude oil. Growth here has been significant, from around $1 billion in 2001 to over $4.7 billion in 2013, peaking at over $5 billion in 2008 just prior to the financial crisis.